UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | | | | |

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | | |

| Check the appropriate box: | | |

| [ ] | | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 |

| [ ] | | Confidential, For Use of the

Commission Only (as permitted

by Rule 14a-6(e)(2)) | | |

| [X] | | Definitive Proxy Statement | |

| [ ] | | Definitive Additional Materials | |

| | | | | | | | |

| The Hartford Financial Services Group, Inc. | |

| (Name of Registrant as Specified In Its Charter) | |

| | |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | | No fee required |

| [ ] | | Fee paid previously with preliminary materials |

| [ ] | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | | |

| | | | | |

NOTICE OF 20222023 ANNUAL MEETING

OF SHAREHOLDERS |

| | | | | | | | | | | | | | | | | |

Date and Time Wednesday, May 18, 202217, 2023 12:30 p.m. EDT Access* www.virtualshareholdermeeting.com/HIG2022HIG2023 Record Date You may vote if you were a shareholder of record at the close of business on March 21, 2022.20, 2023. Voting Items Shareholders will vote ofon the following items of business: | | VOTING | |

| | By internet www.proxyvote.com |

|

| | By toll-free telephone 1-800-690-6903 |

|

| | By mail Follow the instructions on your proxy card |

| Board Recommendation | Page | | | At the Annual Meeting Follow the instructions on the virtual meeting site |

1. Elect a Board of Directors for the coming year; | FOR | 13 | |

| | |

2. Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022;2023; | FOR | 34 | | IMPORTANT INFORMATION IF YOU PLAN TOATTEND THE ANNUAL MEETING: You are entitled to participate (i.e., submit questions and/or vote) in the Annual Meeting if you were a shareholder of record at the close of business on March 21, 2022,20, 2023, the record date, or hold a legal proxy for the meeting provided by your bank, broker, or nominee. To participate, you will need the 16-digit control number provided on your proxy card, voting instruction form or notice. Shareholders may also vote or submit questions in advance of the meeting at www.proxyvote.com using their 16-digit control number. If you are not a shareholder or do not have a control number, you may still access the meeting as a guest, but you will not be able to participate. If you have difficulty accessing the Annual Meeting, please call the number on the registration page of the virtual meeting site. Technicians will be available to assist you. |

3. Consider and approve, on a non-binding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement; | FOR | 36 | |

4. Select, on a non-binding, advisory basis, the preferred frequency for the advisory vote on named executive officer compensation; | 1 YEAR | 69 | |

5. Vote on shareholder proposal that the company’sCompany’s Board adopt policies ensuring itsand disclose a policy for the time bound phase out of underwriting practices do not supportrisks associated with new fossil fuel supplies;exploration and development projects; and

| AGAINST | 70 | |

6.5. Act upon any other business that may properly come before the Annual Meeting or any adjournment thereof.

| | | |

The Hartford’s proxy materials are available via the internet at http://ir.thehartford.com** and www.proxyvote.com, which allows us to reduce printing and delivery costs and lessen adverse environmental impacts. We hope that you will participate in the Annual Meeting, either by attending and voting at the virtual meeting or by voting through other means. For instructions on voting, please refer to page 7778 under “How do I vote my shares?” We urge you to review the proxy statement carefully and exercise your right to vote. Dated: April 8, 20226, 2023 By order of the Board of Directors | |

|

|

|

|

| | | |

| |

| Donald C. Hunt | | | | | |

| Senior Vice President and Corporate Secretary | | | | | |

* In light of the ongoing COVID-19 pandemic,order to support the health and well-being of our shareholders, employees, partners and communities, and to provide a convenient opportunity for shareholders to participate from wherever they are located, the Annual Meeting will be held in a virtual meeting format via audio webcast only, and not at a physical location. |

**References in this proxy statement to our website address are provided only as a convenience and do not constitute, and should not be viewed as, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this this proxy statement. |

| | | | | | | | |

| 20222023 Proxy Statement | 1 |

| | | | | |

LETTER FROM OUR CHAIRMAN & CEO AND LEAD DIRECTOR

| |

Dear fellow shareholders:

2022 was an outstanding year of financial performance and progress for The Hartford delivered strongacross our strategic objectives. During the year, the Board oversaw the Company’s execution on its strategy to maximize value creation for all stakeholders, which focuses on advancing underwriting excellence, enhancing digital capabilities, maximizing distribution channels, optimizing organizational efficiency, and advancing sustainability leadership. As the 2023 Annual Meeting of Shareholders approaches, it is our privilege as Chairman and Lead Director to share details on the Board’s progress in 2022.

As the Board discharged its fiduciary duties, it also underwent fundamental and positive changes to continue our corporate governance leadership. After last year’s retirements of long-serving directors Robert Allardice and Michael Morris from the Board, we were pleased to appoint Edmund Reese, who brings extensive senior leadership experience with several trusted and admired companies and deep knowledge of investments, financial performancereporting, strategic planning, operations and product launches. We believe we continue to have the right mix of skills and expertise necessary to support the Company’s strategy. The current Board is a diverse group whose collective credentials bring varied perspectives to the oversight of The Hartford.

Strong progress has been made towards the Board’s goals for the 2022-2023 Board year. The Board continues to focus on overseeing profitable growth strategies, with an emphasis on creating sustainable long-term value. Examples of focus areas include continued review of growth and innovation in 2021Personal Lines and made significant progressassessment of long-term technology plans as enablers of business strategy. The Board also focused on our ESG journey. Whilehuman capital management, including oversight of development plans for key executive leadership positions, examining broader management succession 1-2 levels down from the majority of our workforce has operated remotely sinceCEO to anticipate future needs. As we emerged from the pandemic, began, our employees remain unitedthe Board also worked with management to define the Company’s future work model while continuing to support a diverse, inclusive and innovative culture. Additionally, the Board continued to enhance its sustainability oversight, particularly the Company’s journey to operationalize and embed it into its broader strategy. The Board also continued to ensure that it engages all directors to actively and closely review critical strategic issues. As the worst of the pandemic is behind us, we’ve also re-initiated direct interaction and engagement between and among Directors and senior management, including in-person events, enhancing opportunities for continuing education, particularly insurance industry education, such as meeting with customers, and refining onboarding protocols. We hope these steps demonstrate the Board's commitment to continuous improvement.

Many of the Board’s strengths - its composition, alignment around strategy, focus on profitable growth, oversight of sustainability, and strong Director engagement - are the direct result of its rigorous multi-step evaluation process. As part of its continuous improvement efforts, the Board undertook a third-party evaluation again in 2022, expanding the scope of the review to include individual director evaluations. The third-party facilitator concluded that the Board continues to function at a very high level and remains deeply committed to serving the Company and its stakeholders.

At the end of 2022, The Hartford’s purposePresident Doug Elliot retired after a distinguished career. As the Company’s President, Doug was instrumental in expanding our suite of products, developing industry-specific verticals within our property & casualty business, overseeing the integration of Navigators and elevating our underwriting human achievement and stand behind our promises to customers and distribution partners.

The Board, too, has operated remotely during this time, and remained highly engaged, meeting virtually 31 times since March 2020. With oversight of the company’s strategic direction, The Board spends significant time at each regularly scheduled Board meeting discussing business unit strategy and performance with business line leaders. Independent directors also meet without management to discuss important issues. An annual strategy deep-dive offers additional opportunity for the directors to probe and question management team members. These ongoing strategy touchpoints allow the Board to affirm that The Hartford is well positioned to deliver maximum value to all stakeholders. As shared during the company’s November 2021 Investor Day, The Hartford seeks to generate superior risk-adjusted returns through:

•Accelerated profitable organic growth across our businesses

•Unwavering focus on ROE performance, driven by underwriting excellence

•Consistent generation of excess capital and optimizing superior returns

•A deep-rooted ethical culture and industry-leading environmental, social and governance (ESG) practices

The Hartford possesses an enviable portfolio of leading, core businesses with sustainable, long-term competitive advantages. Over the last decade, the business has undergone a transformational journey to optimize and restructure the portfolio. Significant investments in digital, data and automated solutions across our businesses have strengthened our competitive advantages. Strong M&A execution has reduced exposure to capital market sensitive, lower ROE producing businesses, while broadening product portfolio and distribution reach in our P&C businesses and adding significant scale to our Group Benefits businesses. Additionally, a disciplined approach to capital management has helped produce strong returns.

The prominence of ESG as a critical strategic priority reflects its importance to the Board and management. The Hartford has led the way in embracing its responsibilities to all stakeholders. We continued to raise the bar in 2021 with accomplishments that include:

•Publication of our first SASB and second TCFD reports

•Release of EEO-1 data

•Disclosure of representation goals for women and people of color in senior management roles, which tie senior executive compensation to their achievement

•Sign-on to the U.N. Global Compact

•Refreshed climate priorities

•Commitment to investing $2.5 billion over the next five years in technologies, companies and funds that advance the energy transition and address climate change

We also expanded director engagement with our largest shareholders and shared video messages from several directors via our website, which offer all stakeholders a better view into The Hartford’s boardroom.excellence. We are proud these efforts have garnered extensive recognition, including The Hartford’s inclusiongrateful for the third straight year as the top-ranked insurance company on JUST Capital list of America’s Most “JUST” Companies for 2022. Going forward, our goal is to further advance the benchmark for ESGhis leadership and wish him well in the U.S. insurance sector while expanding efforts around alternative and renewable energy investments, supplier diversity and emerging shareholder expectations. We understand our role in addressing societal challenges and recognize the importance of ESG to the long-term success of our business and the insurance sector as a whole.his retirement.

To that end, The Hartford has announced our goal to achieve net zero greenhouse gas emissions for its full range of businesses and operations by 2050, in alignment with the Paris Climate Accord. ESG principles are embraced throughout our organization and, like others in the business community, we have set ambitious ESG goals. Today’s announcement builds on our existing initiatives to

further net zero objectives, including the successful implementation of our Coal and Tar Sands Policy; our targets to operate with 100% renewable-energy source consumption for our facilities by 2030 and to reduce select GHGe by at least 2.1% each year starting in 2015 for a total reduction of 46.2% by 2037; and transparent reporting through TCFD and CDP disclosures. While there are many unknowns that will have a direct impact on our ability to achieve our net zero goal, including the development of appropriate reporting and measurement protocols, we remain committed to fostering a cleaner, healthier environment and to balancing stakeholder impact as we navigate the global energy transition. We look forward to sharing more about our plans to achieve these goals in a future update.

At The Hartford, the best is yet to come. We’re positioned to deliver on our financial objectives and enhance value for all stakeholders. At every level of our company, from the boardroom to the underwriting desk toand the call center, we are motivated by our mission of providing people with the support and protection they need to pursue their unique ambitions, seize opportunity, and prevail through unexpected challenge. Thank you for your ongoing support.

| | | | | | | | | | | |

| | | |

| Christopher J. Swift | | Trevor Fetter | |

| Chairman and Chief Executive Officer | | Lead Director | |

| | | | | |

2022 Proxy Statement2 | 3www.thehartford.com |

TABLE OF CONTENTS

| | | | | |

| PROXY SUMMARY | |

| BOARD AND GOVERNANCE MATTERS | |

| Item 1: Election of Directors | |

| Governance Practices and Framework | |

| Board Composition and Refreshment | |

| Committees of the Board | |

| The Board's Role and Responsibilities | |

| Director Compensation | |

| Certain Relationships and Related Party Transactions | |

| Communicating with the Board | |

| Director Nominees | |

| AUDIT MATTERS | |

| Item 2: Ratification of Independent Registered Public Accounting Firm | |

| Fees of the Independent Registered Public Accounting Firm | |

| Audit Committee Pre-Approval Policies and Procedures | |

| Report of the Audit Committee | |

| COMPENSATION MATTERS | |

| Item 3: Advisory Vote to Approve Executive Compensation | |

| Compensation Discussion and Analysis | |

| Executive Summary | |

| Components of the Compensation Program | |

| Process for Determining Senior Executive Compensation (Including NEOs) | |

Pay for2022 Named Executive Officers' Compensation and Performance | |

| Compensation Policies and Practices | |

| Effect of Tax and Accounting Considerations on Compensation Design | |

Compensation and Management Development Committee Interlocks and Insider Participation | |

| Report of the Compensation and Management Development Committee | |

| Executive Compensation Tables | |

| CEO Pay Ratio | |

Item 4: Advisory Approval of Preferred Frequency for Advisory Vote on Executive CompensationPay Versus Performance | |

| SHAREHOLDER PROPOSAL | |

Item 5:4: Vote on Shareholder Proposal That the Company’s Board Adopt Policies Ensuring Itsand Disclose a Policy for the Time Bound Phase Out of Underwriting Practices Do Not SupportRisks Associated with New Fossil Fuel SuppliesExploration and Development Projects | |

| INFORMATION ON STOCK OWNERSHIP | |

| Directors and Executive Officers | |

| Certain Shareholders | |

| Delinquent Section 16(a) Reports | |

| INFORMATION ABOUT THE HARTFORD’S ANNUAL MEETING OF SHAREHOLDERS | |

| Householding of Proxy Materials | |

| Frequently Asked Questions | |

| Other Information | |

| APPENDIX A: RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES | |

Some of the statements in this proxy statement, including those related to our goal of achieving net zero greenhouse gas emissions ("GHGe") for the full range of our businesses and operations by 2050, may be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. We caution investors that these forward-looking statements are not guarantees of future performance, and actual results may differ materially. Factors that could cause actual results to differ, possibly materially, from those in the forward-looking statements include, but are not limited to, our ability to formulate and implement plans to reduce our Scope 1 and 2 GHGe as anticipated; our reliance on third parties, whose actions are outside our control, to reduce our Scope 3 GHGe; and the lack of widely accepted standards for measuring greenhouse gas emissions associated with underwriting, insurance and investment activities, as well as other factors discussed in our 20212022 Annual Report on Form 10-K, subsequent Quarterly Reports on Forms 10-Q, and the other filings we make with the Securities and Exchange Commission. We assume no obligation to update this proxy statement, which speaks as of the date issued.

| | | | | |

42022 Proxy Statement | www.thehartford.com3 |

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. It does not contain all the information you should consider and you should read the entire proxy statement carefully before voting.

BOARD AND GOVERNANCE HIGHLIGHTS

| | | | | | | | |

ITEM 1 ELECTION OF DIRECTORS |

| Each director nominee has an established record of accomplishment in areas relevant to overseeing our businesses and possesses qualifications and characteristics that are essential to a well-functioning and deliberative governing body. |

| ✓ | The Board recommends a vote "FOR" each director nominee |

| | | | | | | | | | | | | | | | | |

| Director Nominee, Current Age

and Present or Most Recent Experience | Independent | Director since | Current Committees(1) | Other Current Public Company Boards |

| Larry D. De Shon, 6263 Former President, CEO and COO, Avis Budget Group | ✓ | 2020 | • Audit

• FIRMCo

• NCG | • AuditUnited Rentals, Inc. • FIRMCo • NCG

| • United Rental, Inc.

• Air New Zealand

|

| Carlos Dominguez, 6364 Former Vice Chairman and Lead Evangelist, Sprinklr | ✓ | 2018 | • Comp

• FIRMCo

• NCG

| • PROS Holdings |

| Trevor Fetter,(2) 62 63 Senior Lecturer, Harvard Business School | ✓ | 2007 | • Comp

• FIRMCo

| None |

| Donna James, 6465 President and CEO, Lardon & Associates | ✓ | 2021 | • Audit

• FIRMCo

• NCG | • Audit • FIRMCo

| • Boston Scientific(3)

• Victoria's Secret • American Electric Power |

| Kathryn A. Mikells, 5657 Chief Financial Officer Exxon Mobil | ✓ | 2010 | • Audit

• FIRMCo* | None |

| • Audit*Edmund Reese, 48

• FIRMCoChief Financial Officer

Broadridge Financial Solutions | ✓ | 2022 | • Audit

• FIRMCo | None |

| Teresa W. Roseborough, 6364 Executive Vice President, General Counsel and Corporate Secretary, The Home Depot | ✓ | 2015 | • Comp

• FIRMCo

• NCG*

| None |

| Virginia P. Ruesterholz, 6061 Former Executive Vice President, Verizon Communications | ✓ | 2013 | • Comp

• FIRMCo

• NCG

| • Bed Bath & Beyond

None |

| Christopher J. Swift, 6162 Chairman and CEO, The Hartford | | 2014 | • FIRMCo | •Citizens Financial Group |

| Matthew E. Winter, 6566 Former President, The Allstate Corporation | ✓ | 2020 | • FIRMCo

• Comp*

| • ADT • H&R Block |

| Greig Woodring, 7071 Former President and CEO, Reinsurance Group of America | ✓ | 2017 | • Audit Audit*

• FIRMCo | None |

* Denotes committee chair.

(1)Full committee names are as follows: Audit – Audit Committee; Comp – Compensation and Management Development Committee; FIRMCo – Finance, Investment and Risk Management Committee; NCG – Nominating and Corporate Governance Committee.

(2)Mr. Fetter serves as the Lead Director. For more details on the Lead Director’s role, see page 14.14 .

(3)Ms. James is not standing for re-election at Boston Scientific, Inc.'s 2023 Annual Meeting.

| | | | | | | | |

| 4 | 2022 Proxy Statement | 5www.thehartford.com |

| | | | | | | | |

PROXY SUMMARY | | PROXY SUMMARY |

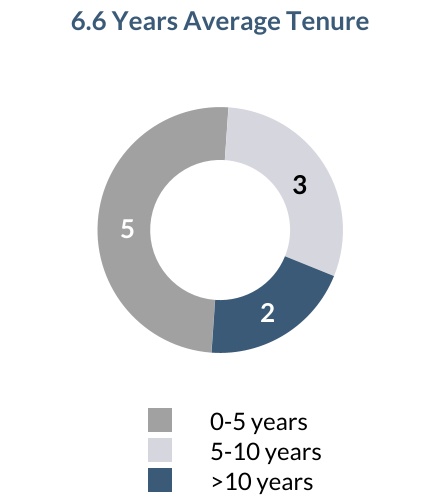

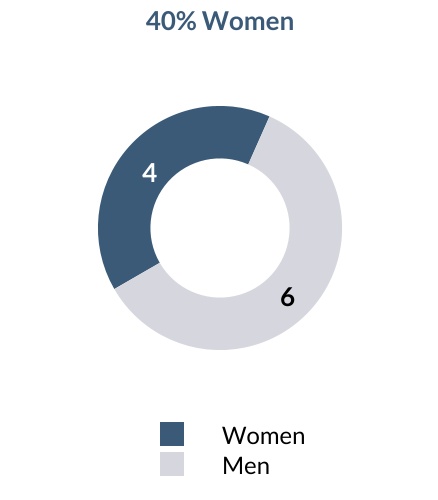

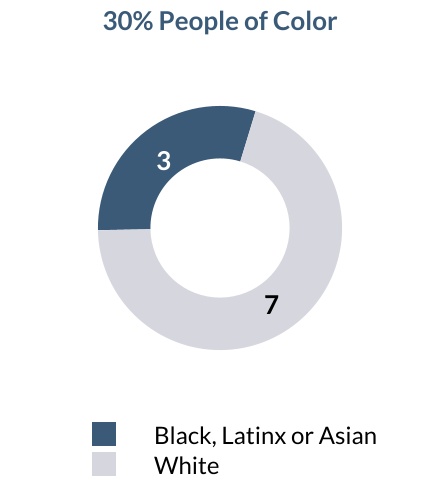

BOARD NOMINEE COMPOSITION

* As of April 6, 2023.

GOVERNANCE BEST PRACTICES

The Board and management regularly review best practices in corporate governance and modify our governance policies and practices as warranted. Our current best practices are highlighted below.

| | | | | | | | | | | | | | |

| Independent Oversight | ✓ | All directors are independent, other than the CEO |

| ✓ | Independent key committees (Audit, Compensation, Nominating) |

| ✓ | Empowered and engaged independent Lead Director |

| Engaged Board /Shareholder Rights | ✓ | All directors elected annually |

| ✓ | Majority vote standard (with plurality carve-out for contested elections) |

| ✓ | Proxy access right with market terms |

| ✓ | Director resignation policy |

| ✓ | Over-boarding policy limits total public company boards, including The Hartford, to five for non-CEOs and two for sitting CEOs |

| ✓ | Rigorous Board and committee self-evaluation conducted annually; third-party Board and individual director evaluations conducted triennially |

| ✓ | Meaningful Board education and training on recent and emerging governance and industry trends |

| ✓ | Annual shareholder engagement program focused on sustainability, compensation and governance issues |

GoodOther Governance Practices | ✓ | Board diversity of experience, tenure, age, gender, race and ethnicity |

| ✓ | Mandatory retirement age of 75 |

| ✓ | Diversity policy or "Rooney Rule" commitment to ensure diverse candidates are included in the pool from which board and external CEO candidates are selected |

| ✓ | Annual review of CEO succession plan by the independent directors with the CEO |

| ✓ | Annual Board review of long-term and emergency succession plans for senior management and the CEO |

| ✓ | Stock-ownership guidelines of 6x salary for CEO and 4x salary for other named executive officers |

| ✓ | Annual Nominating Committee review of The Hartford's political and lobbying policies and expenditures |

Commitment to Sustainability

| ✓ | Board oversight of sustainability matters; Nominating Committee oversight of sustainability governance framework |

| ✓ | Comprehensive sustainability reporting, including a Sustainability Highlight Report, TCFD and SASB reports and EEO-1 data |

| ✓ | Sustainability Governance Committee, including several subcommittees, comprised of senior management charged with overseeing a comprehensive sustainability strategy and ensuring the full Board is briefed at least annually |

SUSTAINABILITY PRACTICES

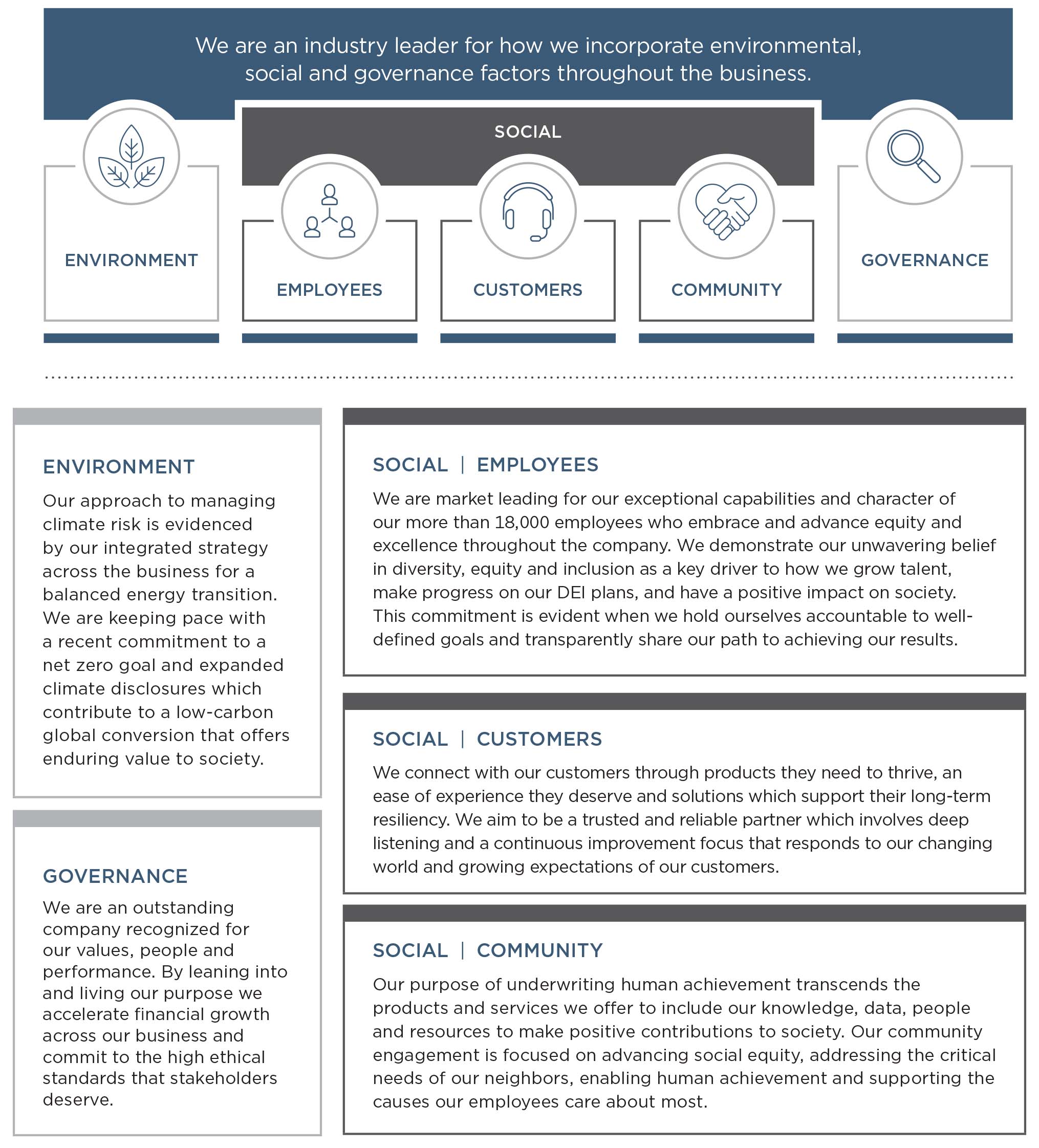

Our approach to sustainability is fundamental to who we are as a company. Environmental, social and governance ("ESG") considerations are deeply embedded in our values, our operational approach, and our strategy. Our strategy rests on a foundation and track record of transparent, measurable goals and actions intended to secure long-term shareholder value and contribute to society at large. Our sustainability efforts address ESG impacts as highlighted in the following key areas:

| | | | | | | | |

| | |

ENVIRONMENT

As an insurer we appreciate the risks that environmental challenges present to people and communities. Our 2050 net zero goal is indicative of that appreciation, and also a motivating force behind our work. As environmental stewards, we commit to mitigating climate change and building community resilience to its impacts.

| | SOCIAL | EMPLOYEES

Responsible growth depends on the attraction, retention and development of top-flight talent. That talent both requires and enables us to fulfill the needs and aspirations of the diverse customers and communities we serve.

|

|

|

|

|

|

|

|

|

| |

| |

| SOCIAL | CUSTOMERS

Our top priority is to foster resiliency – bringing crucial support and peace of mind to our customers through the most challenging of times. Our insight-driven products and our commitment to empathetic, high-quality service are the keys to our customer approach.

|

| |

| |

GOVERNANCE

We are proud of our role as an industry leader in exhibiting outstanding governance practices and ethical standards, and we have fortified our sustainability governance model to reflect that standard and to prepare for the adaptive challenges that ESG will bring.

| |

| |

| |

| SOCIAL | COMMUNITY

Our commitment to our communities transcends the products and services we offer – it includes using our knowledge, data, people and resources to make positive contributions to society. Our community engagement focuses on advancing social equity, addressing the critical needs of our neighbors in our communities, enabling human achievement and supporting the causes our employees care about most.

|

|

|

|

|

| | |

For additional detail on our ESG efforts and performance, please access the Corporate Sustainability section of our website. Our most recent Sustainability Highlight Report, our reporting on net zero progress, and our TCFD, SASB, and EEO-1 reports are all available at: https://www.thehartford.com/about-us/corporate-sustainability.

SUSTAINABILITY PRACTICES

We believe that having a positive impact on the world is the right thing to do and a business imperative. Fostering and safeguarding human achievement has been our business for over two hundred years, and sustainability considerations are integral to our strategy. We recognize that people want to work for, invest in, and buy from an organization that shares their values. Our sustainability efforts address environmental, social and governance ("ESG") impacts as highlighted in the following key areas:

To learn more, please access our Sustainability Highlight Report, which presents our sustainability goals and provides data on our sustainability practices and achievements, as well as our TCFD, SASB, and EEO-1 reports at: https://www.thehartford.com/about-us/corporate-sustainability.

AUDIT HIGHLIGHTS

| | | | | | | | |

ITEM 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

As a matter of good corporate governance, theThe Board is asking shareholders to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2022.2023. |

| ✓ | The Board recommends a vote "FOR" this item |

COMPENSATION HIGHLIGHTS

| | | | | | | | |

ITEM 3 ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION |

The Board is asking shareholders to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. Our executive compensation program is designed to promote long-term shareholder value creation and support our strategy by (1) encouraging profitable organic growth and ROE performance while maintaining an ethical culture supported by industry-leading ESGsustainability practices, (2) providing market-competitive compensation opportunities designed to attract and retain talent needed for long-term success, and (3) appropriately aligning pay with short- and long-term performance. |

| ✓ | The Board recommends a vote "FOR" this item |

The Hartford’s mission is to provide people with the support and protection they need to pursue their unique ambitions, seize opportunity, and prevail through unexpected challenge. Our strategy to maximize value creation for all stakeholders focuses on advancing underwriting excellence, emphasizing digital capabilities, maximizing distribution channels, optimizing organizational efficiency, and advancing ESG leadership.

We endeavor to maintain and enhance our position as a market leader by leveraging our core strengths of underwriting excellence, risk management, claims, product development and distribution. We are investing in claims processing, analytics, data science and digital capabilities to strengthen our existing competitive advantages.

An ethics, people, and performance-focusedperformance-driven culture drives our values. We have taken proactive positions on ESG issues important to our sustainability and our capacity to deliver long-term shareholderstockholder value.

STRATEGIC PRIORITIES

| | | | | | | | |

8 | www.thehartford.com2023 Proxy Statement | 7 |

| | | | | | | | |

| PROXY SUMMARY | | PROXY SUMMARY |

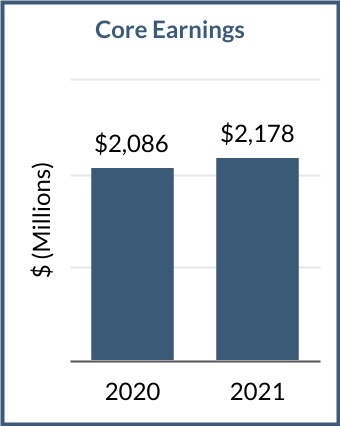

20212022 FINANCIAL RESULTS

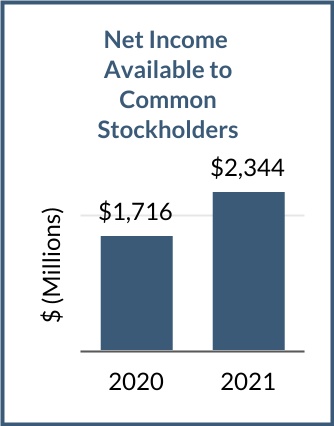

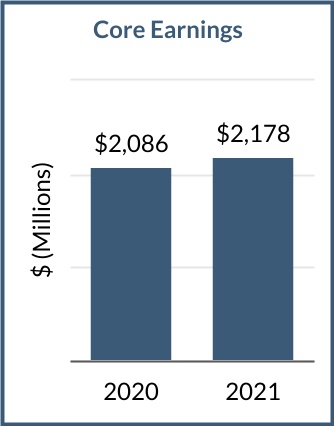

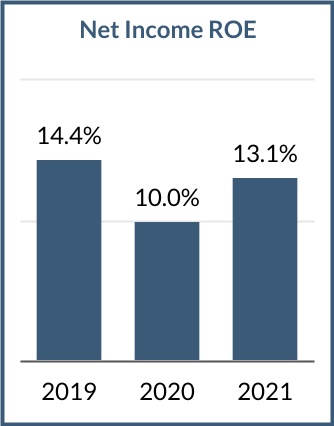

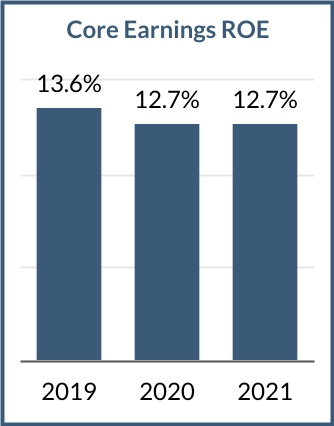

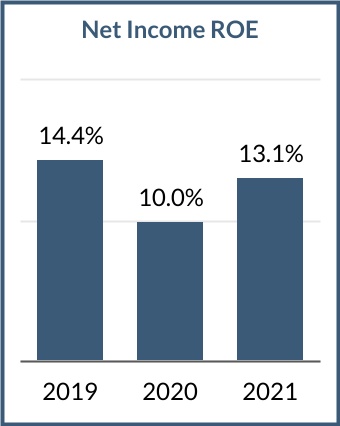

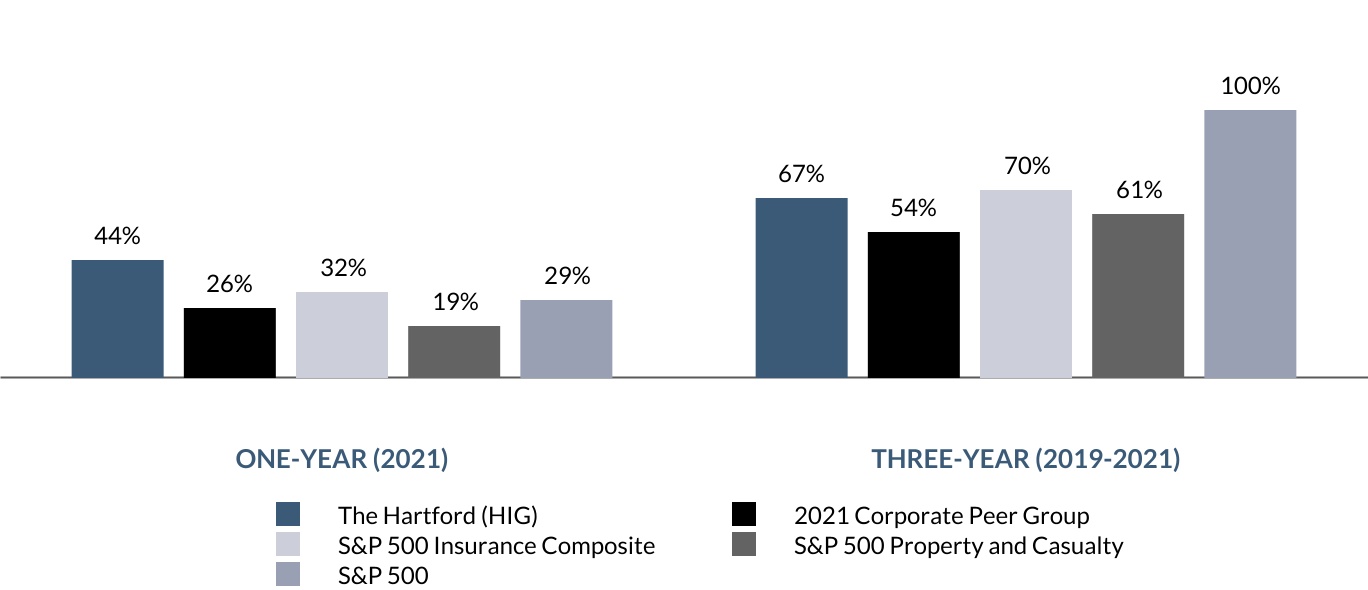

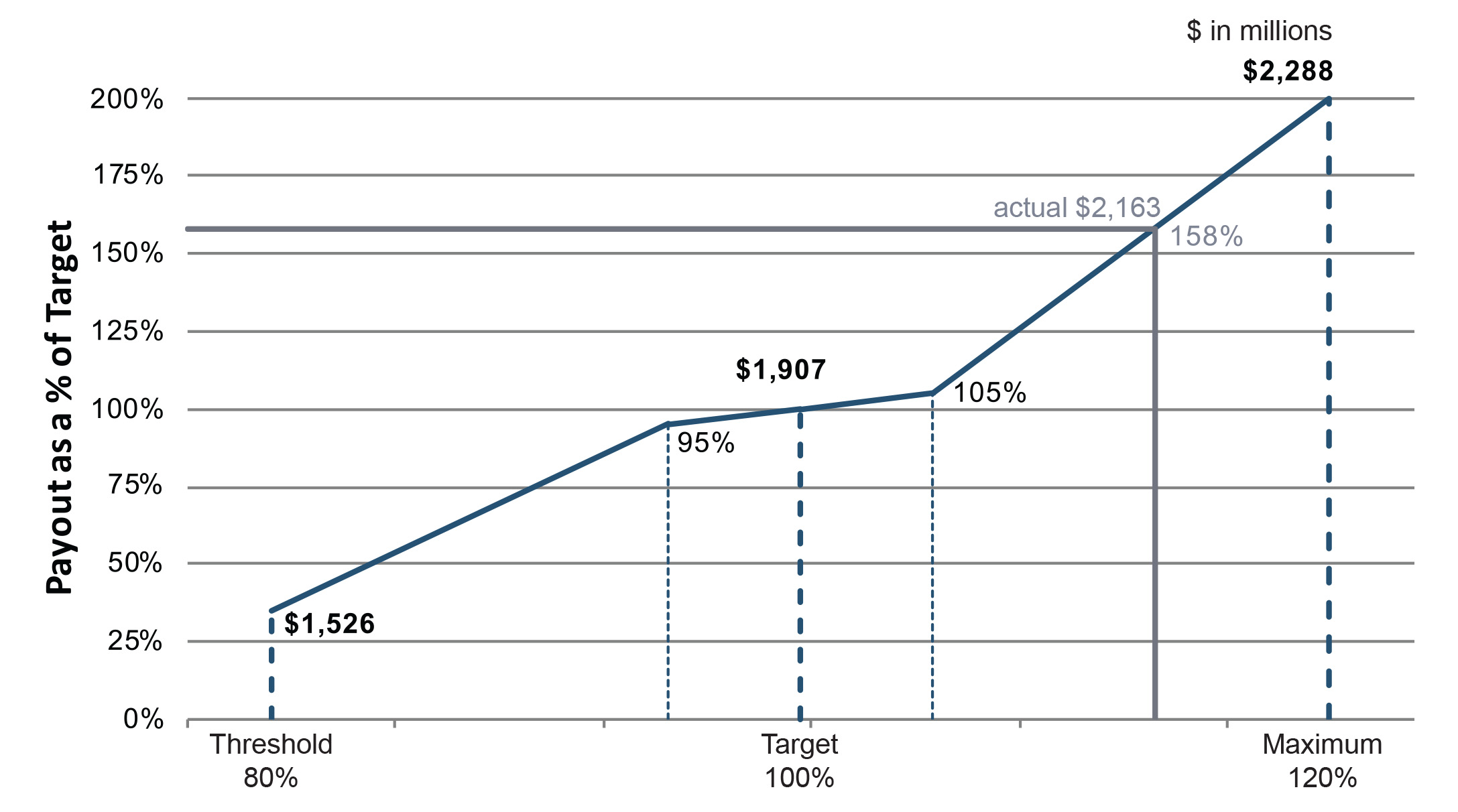

Our 20212022 financial results were excellent, compared to 2020,reflecting strong underwriting with strong limited partnership incomeexcellent premium growth across the business, improved margins before net realized gains (losses), and higher underlying P&C underwriting results, partially offset by a changesignificant contribution from net favorable to net unfavorable P&C prior accident year reserve development and an increase in group life excess mortality claims.the investment portfolio. Full year net income available to common stockholders and core earnings* were $2.34$1.8 billion ($6.625.44 per diluted share) and $2.18$2.5 billion ($6.157.56 per diluted share), respectively. Net income and core earnings return on equity ("ROE")*† were 13.1%11.6% and 12.7%14.4%, respectively.

Highlighted below are year-over-year comparisons of our net income available to common stockholders and core earnings performance and our three-year net income ROE and core earnings ROE results. Core earnings is the primary determinant of our annual incentive plan ("AIP") funding, as described on page 42,43, and average annual core earnings ROE over a three-year performance period is the metric used for 50% of performance shares granted to Senior Executives, as described on page 4546 (in each case, as adjusted for compensation purposes). * Denotes a non-GAAP financial measure. For definitions and reconciliations to the most directly comparable GAAP measure, see Appendix A.

† Net income ROE represents net income available to common stockholders ROE.

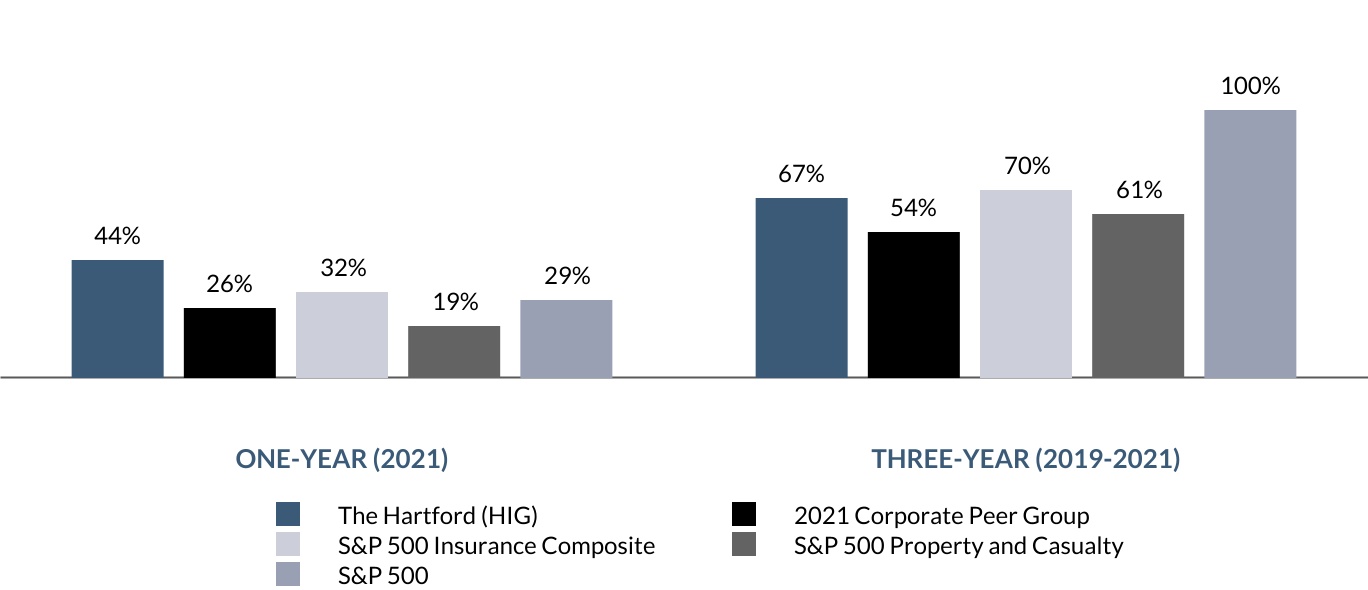

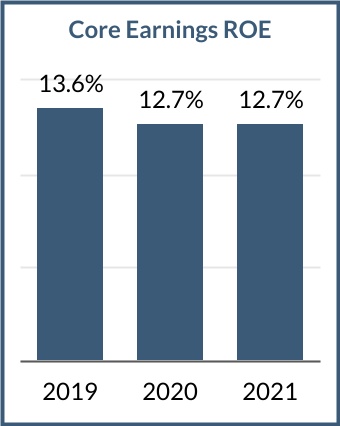

TOTAL SHAREHOLDER RETURNSRETURN

The following chart shows The Hartford's total shareholder return ("TSR") relative to the S&P 500, S&P 500 Insurance Composite and S&P P&C indices and our 20212022 Corporate Peer Group (provided on page 51).52), S&P 500 Insurance Composite, S&P P&C index and S&P 500. Includes reinvestment of dividends.

COMPONENTS OF COMPENSATION AND PAY MIX

NEONamed executive officer compensation is heavily weighted toward variable compensation (annual and long-term incentives), where actual amounts earned may differ from target amounts based on company and individual performance. Each NEO has a target total compensation opportunity that is reviewed annually by the Compensation Committee (in the case of the CEO, by the independent directors) to ensure alignment with our compensation objectives and market practice.

| | | | | | | | |

| 8 | 2022 Proxy Statement | 9www.thehartford.com |

| | | | | | | | |

PROXY SUMMARY | | PROXY SUMMARY |

| | | | | |

| Compensation Component | Description |

| Base Salary | •Fixed level of cash compensation based on market data, internal pay equity, experience, responsibility, expertise and performance.performance |

| Annual Incentive Plan | •Variable cash award based primarily on annual company operating performance against a predetermined financial target and achievement of individual performance goals aligned with the company'sCompany's strategic priorities.priorities |

| Long-Term Incentive Plan | •Variable awards granted based on individual performance, retention and market data. •Designed to drive long-term performance, align senior executive interests with shareholders, and foster retention.retention •Award mix (50% performance shares and 50% stock options) reflectsrewards stock price performance, peer-relative shareholder returns (stock price and dividends) and operating performance.performance |

Approximately 91%92% of CEO target annual compensation and approximately 84% of other NEO target annual compensation are variable based on performance, including stock price performance:

| | | | | | | | |

Target Pay Mix — CEOCEO* |

Salary 9%8%

| Annual Incentive 22%21%

| Long-Term Incentive 69%70%

|

| | |

| | |

| Variable with Performance: 91% |

| | | | | | | | |

Target Pay Mix — Other NEOsNEOs* |

Salary 16%17%

| Annual Incentive 29%26%

| Long-Term Incentive 55%58%

|

| | |

| | |

| Variable with Performance: 84% |

2021*Percentages do not sum to 100% due to rounding.

2022 COMPENSATION DECISIONS

| | | | | | | | |

20212022 Compensation Decisions | | Rationale |

The Compensation Committee updated the payout curve for 2021 AIP awards | | The Compensation Committee updated the AIP curve for 2021 awards to reduce the slope for payouts in the range of +/-5% of target, which increases predictability and reduces volatility of payouts for performance in that range. (page 42) |

The Compensation Committee added a diversity modifier for 2021-2023 performance shares | | The Compensation Committee added a modifier to performance shares awarded in 2021 tied to the company’s diversity and workforce representation goals. The modifier will increase or decrease the aggregate payout on 2021 performance share awards (after compensation core ROE and TSR performance objectives have been determined) by +/- 10% based upon performance against pre-determined year-end 2023 representation goals for women and people of color, with the maximum payout not to exceed 200% of target. The Compensation Committee's intent is to include the modifier with 2024 and 2027 performance share awards to encourage progress toward the Company's 2030 representation goals. (page 46) |

The Compensation Committee approved an AIP funding level of 158%148% of target | | Performance against the pre-established Compensation Core Earnings target produced a formulaic AIP funding level of 158%164% of target. The Compensation Committee undertookreduced this funding level to 148% following its qualitative review, of performance and concludedtaking into account extraordinary returns on real estate partnerships that the formulaic AIP funding level appropriately reflected 2021 performance. Accordingly, no adjustments were made.significantly above operating plan assumptions (page 43)44). |

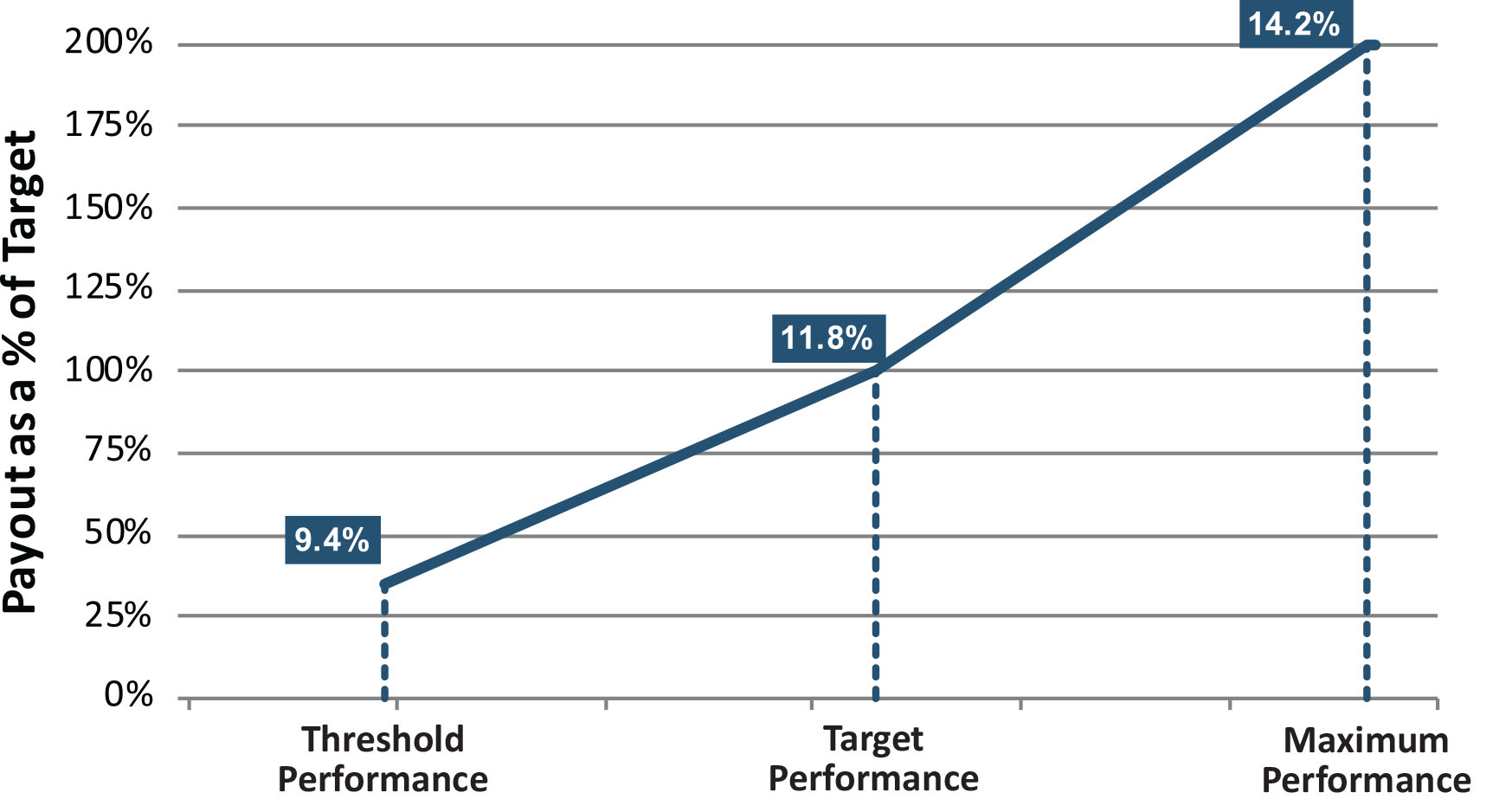

The Compensation Committee certified a 2019-20212020-2022 performance share award payout at 157%121% of target. | | The company'sCompany's average annual Compensation Core ROE during the performance period was 12.2%12.7%, resulting in a payout of 113%163% of target for the ROE component (50% of the award). The company's TSR during the period was at the 87th47th percentile of the performance peers, resulting in a 200%79% payout for the TSR component (50% of the award) (page 47). (page 46) |

The Compensation Committee (and, in the case of the CEO, the independent directors) approved the following compensation for each NEO:

| | | Base Salary | | AIP Award | | LTI Award | | Total Compensation | | | Base Salary | | AIP Award | | LTI Award | | Total Compensation | |

| NEO | NEO | 2021 | Change from 2020 | | 2021 | Change from 2020 | | 2021 | Change from 2020 | | 2021 | Change from 2020 | | NEO | 2022 | Change from 2021 | | 2022 | Change from 2021 | | 2022 | Change from 2021 | | 2022 | Change from 2021 | |

| Christopher Swift | Christopher Swift | $ | 1,150,000 | | 0% | | $ | 4,740,000 | | 97.5% | | $ | 9,250,000 | 8.8% | | $ | 15,140,000 | | 25.6 | % | | Christopher Swift | $ | 1,200,000 | | 4.3 | % | | $ | 4,440,000 | | (6.3) | % | | $ | 10,000,000 | 8.1 | % | | $ | 15,640,000 | | 3.3 | % | |

| Beth Costello | Beth Costello | $ | 725,000 | | 0% | | $ | 2,054,000 | | 105.4% | | $ | 2,000,000 | 8.1% | | $ | 4,779,000 | | 33.7 | % | | Beth Costello | $ | 775,000 | | 6.9 | % | | $ | 1,924,000 | | (6.3) | % | | $ | 2,500,000 | 25.0 | % | | $ | 5,199,000 | | 8.8 | % | |

| Douglas Elliot | Douglas Elliot | $ | 950,000 | | 0% | | $ | 3,002,000 | | 97.5% | | $ | 5,450,000 | 2.6% | | $ | 9,402,000 | | 20.8 | % | | Douglas Elliot | $ | 950,000 | | 0.0 | % | | $ | 2,812,000 | | (6.3) | % | | $ | 5,450,000 | 0.0 | % | | $ | 9,212,000 | | (2.0) | % | |

| David Robinson | David Robinson | $ | 600,000 | | 0% | | $ | 1,224,500 | | 111.1% | | $ | 1,450,000 | 11.5% | | $ | 3,274,500 | | 32.0 | % | | David Robinson | $ | 650,000 | | 8.3 | % | | $ | 1,184,000 | | (3.3) | % | | $ | 2,000,000 | 37.9 | % | | $ | 3,834,000 | | 17.1 | % | |

| Amy Stepnowski | $ | 450,000 | | NA* | | $ | 1,343,000 | | NA* | | $ | 850,000 | NA* | | $ | 2,643,000 | | NA* | | |

| William Bloom | $ | 625,000 | | 0% | | $ | 1,000,000 | | 25.0% | | $ | 1,600,000 | 23.1% | | $ | 3,225,000 | | 18.3 | % | | |

| | Deepa Soni | | Deepa Soni | $ | 650,000 | | NA* | | $ | 1,036,000 | | NA* | | $ | 1,250,000 | NA* | | $ | 2,936,000 | | NA* | |

*Ms. StepnowskiSoni was not previously an NEO.NEO prior to 2022.

This table provides a concise picture of compensation decisions made in 2021,2022, and highlights changes from 2020. In each case, Total 2021 Compensation was higher than 2020 compensation due primarily to the higher AIP awards for 2021. Another view of 20212022 compensation for the NEOs is available in the Summary Compensation Table on page 54.56.

COMPENSATION BEST PRACTICES

Our current compensation best practices include the following:

| | | | | | | | | | | |

| WHAT WE DO |

| ✓ | Compensation heavily weighted toward variable pay |

| ✓ | Senior Executives generally receive the same benefits as other full-time employees |

| ✓ | Double-trigger requirement for cash severance and equity vesting upon a change of control* |

| ✓ | Cash severance upon a change of control not to exceed 2x base salary + bonus |

| ✓ | Independent compensation consultant |

| ✓ | Risk mitigation in plan design and annual review of compensation plans, policies and practices |

| ✓ | Claw-back provisions in compensation and severance plans |

| ✓ | Prohibition on hedging, monetization, derivative and similar transactions with company securities |

| ✓ | Prohibition on Senior Executives pledging company securities |

| ✓ | Stock ownership guidelines for directors and Senior Executives |

| ✓ | Periodic review of compensation peer groups |

| ✓ | Competitive burn rate and dilution for equity program |

* Double-trigger vesting for equity awards applies if the awards are assumed or replaced with substantially equivalent awards.

| | | | | | | | | | | |

| WHAT WE DON'T DO |

| û | No Senior Executive tax gross-ups for perquisites or excise taxes on severance payments |

| û | No individual employment agreements |

| û | No granting of stock options with an exercise price less than the fair market value of our common stock on the date of grant |

| û | No re-pricing of stock options |

| û | No buy-outs of underwater stock options |

| û | No reload provisions in any stock option grant |

| û | No payment of dividends or dividend equivalents on equity awards until vesting |

SAY-ON-PAY RESULTS

At our 20212022 annual meeting, we received 96%approximately 94% support on Say-on-Pay. The Compensation Committee considered the vote to be an endorsement of The Hartford’s executive compensation programs and policies, and recent program changes. They took this strong level of support into account in their ongoing review of those programs and policies. Management also discussed the vote, along with aspects of its executive compensation, sustainability and corporate governance practices, during our annual shareholder

engagement program to gain a deeper understanding of shareholders’ perspectives. Feedback regarding the compensation program was generally positive, with many shareholders expressing support for the Compensation Committee's addition of a diversity modifier to performance share awards. awards in 2021. For further discussion of our shareholder engagement program, see page page 21.

| | | | | | | | |

ITEM 4 ADVISORY APPROVAL OF PREFERRED FREQUENCY FOR ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

|

Section 14A of the Securities Exchange Act of 1934, as amended, provides that shareholders can indicate their preference, at least once every six years, as to how frequently the company should seek an advisory vote on NEO compensation as disclosed pursuant to the SEC's compensation disclosure rules. By voting on this proposal, shareholders may indicate whether they would prefer that the company seek future advisory votes on NEO compensation once every one, two, or three years. |

✓ | The Board recommends that shareholders vote for the option of every "1 year" as the frequency with which shareholders are provided an opportunity to vote on named executive officer compensation, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

|

| | | | | | | | |

ITEM 5

SHAREHOLDER PROPOSAL THAT THE COMPANY'S BOARDCOMPANY ADOPT POLICIES ENSURING ITSAND DISCLOSE A POLICY FOR THE TIME BOUND PHASE OUT OF UNDERWRITING PRACTICES DO NOT SUPPORTRISKS ASSOCIATED WITH NEW FOSSIL FUEL SUPPLIESEXPLORATION AND DEVELOPMENT PROJECTS |

Vote on the shareholder proposal that The Hartford’s Board of Directors adopt and disclose new policies to help ensure that itsa policy for the time bound phase out of underwriting practices do not supportrisks associated with new fossil fuel supplies, in alignment with the IEA’s Net Zero Emissions by 2050 Scenario.exploration and development projects. |

| × | The Board of Directors unanimously recommends that shareholders vote "AGAINST" this Proposal for the following reasons: •The Hartford ishas established itself as a U.S. insurance industry leader in the insurance industry in its effortscommitment to address climate change through a proactive, balanced and supportpragmatic approach. •Proscriptive approaches to address climate change fail to account for the globalcomplexities of the U.S. insurance system or the role the fossil fuel industry must play in energy transition;transition. Divestitures and boycotts are not the optimal foundation to reach net zero. •The Hartford has announcedRecent geopolitical and economic events have underscored the need for insurers to remain pragmatic and flexible in their underwriting approach during the energy transition. •U.S. insurers are operating in an increasingly complex regulatory environment, making a goalbalanced and pragmatic approach to achieve net zero greenhouse gas emissions for its full rangeunderwriting of businessvital importance. •A strong majority and operations by 2050, in alignment with the Paris Climate Accord; •The Hartford does notwide variety of stakeholders support divestiture-first strategies as an effective path to net zero;

•The Proposal would create regulatory risk and complexity without any benefit;

•The Proposal would encroach upon The Hartford’s underwriting judgment; and

•The Proposal runs counter to shareholder sentiment and the direct feedback we have heard during our regular discussions with shareholders.energy transition approach.

|

| | | | | | | | |

12 | www.thehartford.com2023 Proxy Statement | 11 |

BOARD AND GOVERNANCE MATTERS

| | | | | | | | |

ITEM 1 ELECTION OF DIRECTORS |

The full Board, including its Nominating and Corporate Governance Committee, believes the director nominees possess qualifications, skills and experience that are consistent with the standards for the selection of nominees for election to the Board set forth in our Corporate Governance Guidelines described beginning on pages 16-17 page 16and have demonstrated the ability to effectively oversee The Hartford’s corporate, investment and business operations. Biographical information for each director nominee is described beginning on page 29, includingpage 28, including the principal occupation and other public company directorships (if any) held in the past five years and a description of the specific experience and expertise that qualifies each nominee to serve as a director of The Hartford. |

| ✓ | The Board recommends a vote "FOR" each director nominee |

GOVERNANCE PRACTICES AND FRAMEWORK

At The Hartford, we aspire to be an exceptional company celebrated for financial performance, character, and customer value. We believe goodstrong governance practices and responsible corporate behavior are central to this vision and contribute to our long-term performance. Accordingly, the Board and management regularly consider best practices in corporate governance and shareholder feedback and modify our governance policies and practices as warranted. Our current best practices include:

| | | | | | | | | | | | | | |

| Independent Oversight | ✓ | All directors are independent, other than the CEO |

| ✓ | Independent key committees (Audit, Compensation, Nominating) |

| ✓ | Empowered and engaged independent Lead Director |

| Engaged Board /Shareholder Rights | ✓ | All directors elected annually |

| ✓ | Majority vote standard (with plurality carve-out for contested elections) |

| ✓ | Proxy access right with market terms |

| ✓ | Director resignation policy |

| ✓ | Over-boarding policy limits total public company boards, including The Hartford, to five for non-CEOs and two for sitting CEOs |

| ✓ | Rigorous Board and committee self-evaluation conducted annually; third-party Board and individual director evaluations conducted triennially |

| ✓ | Meaningful Board education and training on recent and emerging governance and industry trends |

| ✓ | Annual shareholder engagement program focused on sustainability, compensation and governance issues |

GoodOther Governance Practices | ✓ | Board diversity of experience, tenure, age, gender, race and ethnicity |

| ✓ | Mandatory retirement age of 75 |

| ✓ | Diversity policy or "Rooney Rule" commitment to ensure diverse candidates are included in the pool from which board and external CEO candidates are selected |

| ✓ | Annual review of CEO succession plan by the independent directors with the CEO |

| ✓ | Annual Board review of long-term and emergency succession plans for senior management and the CEO |

| ✓ | Stock-ownership guidelines of 6x salary for CEO and 4x salary for other named executive officers |

| ✓ | Annual Nominating Committee review of The Hartford's political and lobbying policies and expenditures |

Commitment to Sustainability

| ✓ | Board oversight of sustainability matters; Nominating Committee oversight of sustainability governance framework |

| ✓ | Comprehensive sustainability reporting, including a Sustainability Highlight Report, TCFD and SASB reports and EEO-1 data |

| ✓ | Sustainability Governance Committee, including several subcommittees, comprised of senior management charged with overseeing a comprehensive sustainability strategy and ensuring the full Board is briefed at least annually |

| | | | | | | | |

| 12 | 2022 Proxy Statement | 13www.thehartford.com |

| | | | | | | | |

| | BOARD AND GOVERNANCE MATTERS | | |

The fundamental responsibility of our directors is to exercise their business judgment to act in what they reasonably believe to be the best interests of The Hartford and its shareholders. The Board fulfills this responsibility within the general governance framework provided by the following documents:

•Articles of Incorporation

•By-laws

•Corporate Governance Guidelines (compliant with the listing standards of the New York Stock Exchange ("NYSE") and including guidelines for determining director independence and qualifications)

•Charters of the Board’s four standing committees (the Audit Committee; the Compensation and Management Development Committee ("Compensation Committee"); the Finance, Investment and Risk Management Committee ("FIRMCo"); and the Nominating and Corporate Governance Committee ("Nominating Committee"))

•Code of Ethics and Business Conduct

•Code of Ethics and Business Conduct for Members of the Board of Directors

Copies of these documents are available on our investor relations website at http://ir.thehartford.com or upon request sent to our Senior Vice President and Corporate Secretary (see page 7980 for details). DIRECTOR INDEPENDENCE

The Board annually reviews director independence under applicable law, the listing standards of the NYSE and our Corporate Governance Guidelines. In addition, per our Corporate Governance Guidelines, in order to identify potential conflicts of interest and to monitor and preserve the independence, any director who wishes to become a director of another for-profit entity must obtain the pre-approval of the Nominating Committee. The Board has affirmatively determined that all directors other than Mr. Swift are independent.

In making its independence determination, the Board examined the Company’s relationship with Broadridge Financial Solutions, Inc. and its subsidiaries (“Broadridge”), where Edmund Reese, one of our Directors, is Chief Financial Officer. The Board considered that (1) the amounts payable under vendor agreements entered into in the ordinary course of business with Broadridge represent less than 1% of its consolidated gross revenues; and (2) the Company had a relationship with Broadridge prior to Mr. Reese's service as a Director of the Company, and concluded that the relationship was not material.

| | | | | | | | |

| BOARD AND GOVERNANCE MATTERS | | |

BOARD LEADERSHIP STRUCTURE

| | | | | | | | |

| Board Chair | | Independent Lead Director |

The roles of CEO and Chairman of the Board (“Chairman”) are held by Christopher Swift. Mr. Swift has served as CEO since July 1, 2014, and was appointed Chairman on January 5, 2015. In late 2014, before Mr. Swift assumed the role of Chairman, the Board deliberated extensively on our board leadership structure, seeking feedback from shareholders and considering corporate governance analysis. The Board concluded then, and continues to believe, that our historical approach of combining the roles of CEO and Chairman while maintaining strong, independent board leadership is the optimal leadership structure for the Board to carry out its oversight of our strategy, business operations and risk management. The Board believes other elements of our corporate governance structure ensure independent directors can perform their role as fiduciaries in the Board’s oversight of management and our business, and minimize any potential conflicts that may result from combining the roles of CEO and Chairman. For example: • All directors other than Mr. Swift are independent; • An empowered and engaged Lead Director provides independent Board leadership and oversight; and • At each regularly scheduled Board meeting, the non-management directors meet in executive session without the CEO and Chairman present (twenty-one(six such meetings in 2021)2022). As part of its evaluation process, the Board reviews its leadership structure annually as part of its evaluation process to ensure it continues to serve the best interests of shareholders and positions the companyCompany for future success. | | Whenever the CEO and Chairman roles are combined, our Corporate Governance Guidelines require the independent directors to elect an independent Lead Director. Trevor Fetter was elected our Lead Director in May 2017. The responsibilities and authority of the Lead Director include the following: •Presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; •Serving as a liaison between the CEO and Chairman and the non-management directors; •Regularly conferring with the Chairman on matters of importance that may require action or oversight by the Board, ensuring the Board focuses on key issues and tasks facing The Hartford; •Approving information sent to the Board and meeting agendas for the Board; •Approving the Board meeting schedules to help ensure that there is sufficient time for discussion of all agenda items; •Maintaining the authority to call meetings of the independent non-management directors; •Approving meeting agendas and information for the independent non-management sessions and briefing, as appropriate, the Chairman on any issues arising out of these sessions; •If requested by shareholders, ensuring that they are available, when appropriate, for consultation and direct communication; and •Leading the Board’s evaluation process and discussion on board refreshment and director tenure, as well as setting and reviewing board goals. The Board believes that these duties and responsibilities provide for strong independent Board leadership and oversight. |

| | | | | | | | |

| | BOARD AND GOVERNANCE MATTERS |

ANNUAL BOARD EVALUATION PROCESS

The Nominating Committee oversees the Board's multi-step evaluation process to ensure an ongoing, rigorous assessment of the Board’s effectiveness, composition and priorities and to inform the Board's succession planning. In addition to the full Board evaluation process, the standing committees of the Board undertake separate self-assessments on an annual basis.

As part of a multi-year effort to enhance the evaluation process, the Board has adopted the following changes:

•2016 - Adopted individual director interviews led by the Lead Director and a mid-year review of progress against formal Board goals;

•2018 - Adopted third-party facilitated evaluations every three years, commencing in 2019, to promote more candid conversations, provide a neutral perspective, and help the Board benchmark its corporate governance practices; and

•2020 - Adopted individual director evaluations every three years, commencing in 2022, as part of the third-party facilitated Board evaluation.

In each case, the Board sought and considered shareholder feedback on the merits of these changes prior to adoption.

| | | | | | | | |

| | BOARD AND GOVERNANCE MATTERS |

| | | | | | | | |

| Board Evaluation and Development of Goals (May) | The Lead Director, or third-party evaluator, leads a Board evaluation discussion in an executive session guided by the Board’s self-assessment questionnaire and key themes identified through one-on-one discussions. The Board identifies successes and areas for improvement from the prior Board year and establishes formal goals for the year ahead. |

| Annual Corporate Governance Review / Shareholder Engagement Program (October to December) | The Nominating Committee performs an annual review of The Hartford's corporate governance policies and practices in light of best practices, recent developments and trends. In addition, the Nominating Committee reviews feedback on governance issues provided by shareholders during our annual shareholder engagement program. |

| Interim Review of Goals (December) | The Lead Director leads anthe Board's interim review of progress made against the goals established during the Board evaluation discussion in May. |

| Board Self-Assessment Questionnaires (February) | The governance review and shareholder feedback inform the development of written questionnaires that the Board and its standing committees use to help guide self-assessment. The Board’s questionnaire covers a wide range of topics, including the Board’s: • Fulfillment of its responsibilities under the Corporate Governance Guidelines; • Effectiveness in overseeing our business plan, strategy and risk management; • Leadership structure and composition, including mix of experience, skills, diversity and tenure; • Relationship with management; and • Processes to support the Board’s oversight function. |

| One-on-One Discussions (February to May) | The Lead Director, or third-party evaluator, meets individually with each independent director on Board effectiveness, dynamics and areas for improvement. Beginning in 2022, third-party led discussions also include directors' evaluations of their peers. |

When the Lead Director ledAs part of its continuous improvement efforts, the Board undertook a third-party evaluation sessionagain in May 2021, there2022, expanding the scope of the review to include individual director evaluations. The evaluation was agreementbased on a board performance survey, preliminary due diligence, research and review of Company documents, and in-depth interviews of all twelve then-current Board members, as well as select members of senior management and advisors who regularly interact with the Board. The third-party facilitator concluded that despite significant challenges experienced in recent years, including the pandemic, an unsolicited acquisition approach and director turnover, the Board maintainedcontinues to function effectively and remains deeply committed to serving the Company and its focus on stated goals in 2020, but appropriately shifted its focus due to the pandemic.stakeholders. As a result there was a high degree of continued interest from 2020-2021 prioritiesthe individual director evaluations, each Director received actionable feedback to 2021-2022 priorities, with some change in emphasis. There was also agreement that the Board was fully effective in virtual meetings, and was successful in integrating and adding new members.further enable their effectiveness. At the same time, there was consensus around the 2021-20222022-2023 goals for the Board, including driving profitable growth strategies, overseeing stronghuman capital management, succession processes, monitoring the future economic landscape, focusing on the Personal Lines business,evolving ESG oversight, and staying abreast of cyber threats and preparedness.optimizing Board practices.

| | | | | | | | |

| 20222023 Proxy Statement | 15 |

| | | | | | | | |

| BOARD AND GOVERNANCE MATTERS | | |

BOARD COMPOSITION AND REFRESHMENT

DIRECTOR SUCCESSION PLANNING

The Nominating Committee is responsible for identifying and recommending to the Board candidates for Board membership. Throughout the year, the Nominating Committee considers the Board’s composition, skills and attributes to determine whether they are aligned with our long-term strategy and major risks, and each year devotes a session to board succession planning over a longer-term (generally three-year) period. The succession planning process is informed by the results of the Board and committee evaluation processes, as well as anticipated needs in light of The Hartford’s retirement policy (described below). To assist the Nominating Committee in identifying prospective Board nominees when undertaking a search, the companyCompany retains an outside search firm. The Nominating Committee also considers candidates suggested by its members, other Board members, management and shareholders.

The Nominating Committee evaluates candidates against the standards and qualifications set forth in our Corporate Governance Guidelines as well as other relevant factors, including the candidate's potential contribution to the diversity of the Board. In 2018 the Board amended our Corporate Governance Guidelines to ensure that diverse candidates are included in the pool from which board candidates are selected.

The Nominating Committee's most recent director search culminated in the election of Donna James,Edmund Reese, who brings extensive insurance industrysenior leadership experience gained during a 25-year career as a senior executive at Nationwide Insurance, as well as significant corporate governancewith several trusted and admired companies, and deep experience by virtue of her service on several major public company boards. Ms. James’in investments, financial reporting, strategic planning, operations and product launches. Mr. Reese's election made herhim the fourth female member, and third member of color of the current Board. SheHe joined the Board in February 2021,October 2022, and was also at that time appointed to the Audit Committee in May 2021 and the Nominating and Corporate Governance Committee effective in May 2022.FIRMCo.

The graphic below illustrates our typical succession planning process, which begins with an assessment of the Board's current skills and attributes, and then identifies skills or attributes that are needed, or may be needed in the future, in light of the company'sCompany's strategy.

Overview of Director Search Process

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Development of Candidate Specification | | | Screening of Candidates | | | Meeting With Candidates | | | Decision and Nomination |

•Develop skills matrix to identify desired skills and attributes, including diversity

•Target areas of expertise aligned with our strategy | | •Select outside search firms to lead process and/or consider internal or shareholder recommendations

•Screen candidates for each specification identified | | •Top candidates are interviewed by Nominating Committee members, other directors, and management

•Finalist candidates undergo background and conflicts checks | | •Nominating Committee recommendation of candidates and committee assignments to full Board

•Board consideration and adoption of recommendation |

DIRECTOR ONBOARDING AND ENGAGEMENT

All directors are expected to invest the time and energy required to gain an in-depth understanding of our business and strategy. Our director onboarding program is designed to reduce the learning curve for new members and enable them to provide meaningful contributions to the oversight of the companyCompany as early in their tenures as possible. It consists of two phases. Phase one is designed to provide a solid foundation on our businesses, financial performance, strategy, risk and governance. New directors devote numerous briefing sessions with senior management to review key functional areas of the companyCompany and their committee assignment responsibilities. Phase two is an opportunity for new directors to continue learning about the business at their discretion after they have been on the Board for six to twelve months. Directors are afforded time to familiarize themselves with the companyCompany so they can identify areas for additional education and development. In addition, we have formalized our board mentorship program to help integrate members with experienced directors. New directors are also encouraged to attend all committee meetings during their first year to help accelerate their understanding of the companyCompany and the Board.

Our Board members also participate in companyCompany activities and engage directly with our employees at a variety of events throughout the year, including typically an annual dinner with employees working on key strategic business priorities or engaged with ourparticipation in senior leadership team meetings, employee town halls and employee resource groups ("ERGs"). Although the pandemic continued to limit in-person involvement in 2021, directors participated in virtual town hall meetings and ERG events.group meetings.

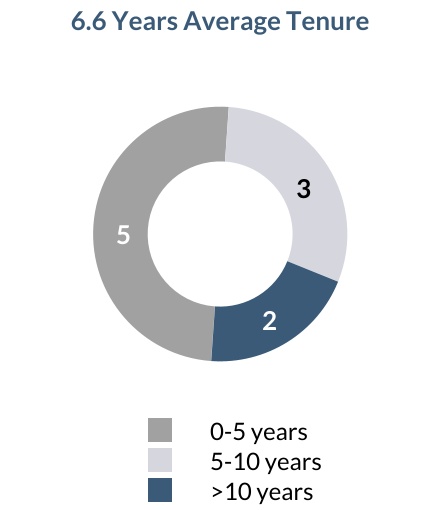

DIRECTOR TENURE

The Nominating Committee strives for a Board that includes a mix of varying perspectives and breadth of experience. Newer directors bring fresh ideas and perspectives, while longer tenured directors bring extensive knowledge of our complex operations. As part of its annual evaluation process, the Board assesses its overall composition, including director tenure, and does not believe the independence of any director nominee is compromised solely due to Board tenure. The Board believes that its rigorous self-self-evaluation process (described above), combined with its mandatory retirement policy at age 75, are effective in promoting Board

| | | | | | | | |

| | BOARD AND GOVERNANCE MATTERS |

evaluation process (described above), combined with its mandatory retirement policy at age 75, are effective in promoting Board renewal, as demonstrated by the addition of seveneight new directors since 2015, and the mandatory retirement of two of our longest tenured directors thislast year.

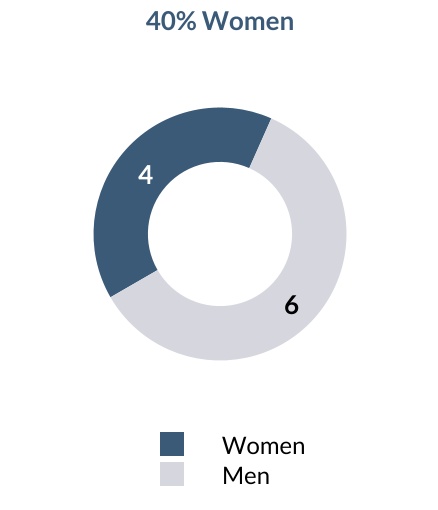

DIRECTOR DIVERSITY

The Board believes a diverse membership with varying perspectives and breadth of experience is an important attribute of a well-functioning board and contributes positively to robust discussion at meetings.driving positive outcomes. The Nominating Committee considers diversity in the context of the Board as a whole and takes into account considerations relating to race, gender, ethnicity and the range of perspectives the directors bring to their Board work. As part of its consideration of prospective nominees, the Board and the Nominating Committee monitor whether the directors as a group meet The Hartford’s criteria for the composition of the Board, including diversity considerations. As part of our continuing efforts to bring diverse perspectives to the Board:

•Since 2010, the Board has appointed five women and threefour people of color as directors;

•The Board's AuditFIRMCo and Nominating Committees are both currently chaired by women; and

•In 2018, the Board amended our Corporate Governance Guidelines to ensure that diverse candidates are included in the pool from which board candidates are selected; and

•In 2021, Donna James joined the Board, increasing the current representation on the Board to four female directors and three directors of color.selected.

BOARD NOMINEE COMPOSITION

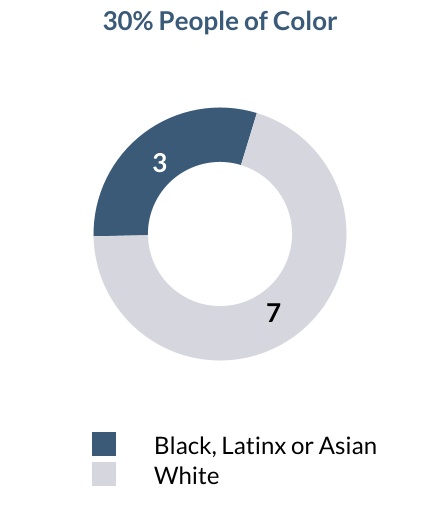

The Board currently has an average tenure of 8 years, is 33% women, and 25% people of color; however, two of our longest-tenured directors will reach our mandatory retirement age in 2022. The charts below reflect average tenure and representation of women and people of color for the director nominees standing for election at the date of the Annual Meeting of Shareholders.

* As of April 6, 2023.

SHAREHOLDER PROPOSED NOMINEES

The Nominating Committee will consider director candidates recommended by shareholders using the same criteria described above. Shareholders may also directly nominate someone for election at an annual meeting. Nominations for director candidates are closed for 2022.2023. To nominate a candidate at our 20232024 Annual Meeting, notice must be received by our Senior Vice President and Corporate Secretary at the address below by February 17, 202316, 2024 and must include the information specified in our By-laws, including, but not limited to, the name of the candidate, together with a brief biography, an indication of the candidate’s willingness to serve if elected, and evidence of the nominating shareholder’s ownership of our Common Stock.

Pursuant to our proxy access By-law, a shareholder, or group of up to 20 shareholders, may nominate a director and have the nominee included in our proxy statement. The shareholder, or group collectively, must have held at least 3% of our Common Stock for three years in order to make a nomination, and may nominate as many as two directors, or a number of directors equal to 20% of the Board, whichever is greater, provided that the shareholder(s) and the nominee(s) satisfy the requirements in our By-laws. Notice of proxy access director nominees for inclusion in our 20232024 proxy statement must be received by our Senior Vice President and Corporate Secretary at the address below no earlier than November 9, 20228, 2023 and no later than December 9, 2022.8, 2023.

In each case, submissions must be delivered or mailed to Donald C. Hunt, Senior Vice President and Corporate Secretary, The Hartford Financial Services Group, Inc., One Hartford Plaza, Hartford, CT 06155.

| | | | | | | | |

| 20222023 Proxy Statement | 17 |

| | | | | | | | |

| BOARD AND GOVERNANCE MATTERS | | |

COMMITTEES OF THE BOARD

The Board has four standing committees: the Audit Committee; the Compensation Committee; FIRMCo; and the Nominating Committee. The Board has determined that all of the members of the Audit Committee, the Compensation Committee and the Nominating Committee qualify as “independent” under applicable law, the listing standards of the NYSE and our Corporate Governance Guidelines. The current members of the Board, the committees on which they serve and the primary functions of each committee are identified below.

| | | | | | | | |

| AUDIT COMMITTEE |

CURRENT MEMBERS:* R. Allardice III

L. De Shon D. James K. Mikells (Chair) M. MorrisE. Reese

G. Woodring (Chair) MEETINGS IN 2021:2022: 9 | “The Audit Committee had a heightenedcontinued to focus on management’s business and technology risk assessments, devoting particular attention to oversight of talent and cyber risks particularly givenin light of external factors, such as evolving labor market conditions and the increased incidence of ransomware attacks and the expanding threat landscape.attacks. The Committee also continued to review in-depth assessments of overall risk and control environments for several lines of business and functional areas, while also reviewing processes for evaluating loss reserves that are more difficult to estimate, including reservesas well as the Company’s readiness to implement the new accounting standard for excess mortality claimslong duration insurance contracts beginning in the Group Benefits business.2023." Kathryn Mikells,Greig Woodring, Committee Chair since 20192022

ROLES AND RESPONSIBILITIES •Overseesthe integrity of the company's financial statements. •Oversees accounting, financial reporting and disclosure processes and theadequacy of management’s systems of internal control over financial reporting. •Oversees the company's relationship with, and performance of, the independent registered public accounting firm, including its qualifications and independence. • Considers appropriateness of rotation of independent registered public accounting firmfirm. •Oversees the performance of the internal audit function. •Oversees operational risk, business resiliency and cybersecurity. •Oversees the company's compliance with legal and regulatory requirements and our Code ofEthics and Business Conduct. •Discusses with management policies with respect to risk assessment and riskmanagement. |

* The Board has determined that all members are “financially literate” within the meaning of the listing standards of the NYSE and “audit committee financial experts” within the meaning of the SEC’s regulations. |

| | | | | | | | |

| | BOARD AND GOVERNANCE MATTERS |

| | | | | |

| COMPENSATION AND MANAGEMENT DEVELOPMENT COMMITTEE |

CURRENT MEMBERS: C. Dominguez T. Fetter T. Roseborough V. Ruesterholz M. Winter (Chair)

MEETINGS IN 2021:2022: 6 | “When making compensation decisionsIn 2022, the Compensation and Management Development Committee focused on the Company’s continued human capital management progress with respect to attracting, retaining and developing talent; and maintaining a high performing culture. The Committee reviewed the 2021 performance year,Company’s talent strategy and its meaningful progress towards advancing its talent agenda, in addition to factors such asparticular the evolution of the Company’s DEI program and other strategic initiatives. The Hartford’s outstanding operationalCommittee also reviewed an executive leadership team retention assessment, succession and share price performance, the Compensation Committee considered The Hartford’s progress to attract, retain and develop talent,development plans, as well as ongoing efforts to create a diverse, equitable and inclusive culture. The Hartford made significant progress on its talent and DEI agenda in 2021, including the internal promotions of female executives to the roles of Chief Information Officer, Chief Ethics and Compliance Officer and Chief Claims Officer – which were the result of deliberateCEO emergency succession planning that capitalized on our deep bench strength – as well as the external hire of a new Chief Marketing Officer. Over the course of the year as the workforce continued to navigate the pandemic, the Committee also monitored the actions the company took to support employee health and well-being while continuing to foster a high-performance culture.plans.” Matthew Winter, Committee Chair since 2021 ROLES AND RESPONSIBILITIES •Oversees executive compensation and assists in defining an executive totalcompensation policy. •Works with management to develop a clear relationship between pay levels,performance and returns to shareholders, and to align compensation structurewith objectives. •Has the authority to delegate, and has delegated to the Executive Vice President, Human Resources, or her designee, the authority to carry out administrative responsibilities under incentive compensation plans. •Has sole authority to retain, compensate and terminate any consulting firm used toevaluate and advise on executive compensation matters. •Considers independence standards required by the NYSE or applicable law prior to retaining compensation consultants, accountants, legal counsel or other advisors. •Reviews initiatives and progress in the area of human capital management, including an annual review of the diversity of the company’s workforce and diversity, equity and inclusion (“DE&I”DEI”) programs, and of the company’s process and analysis for assessing pay equity. • Reviews succession and continuity plans for the CEO and each member of the executive leadership team that reports to the CEO. • Meets annually with a senior risk officer to discuss and evaluate whether incentive compensation arrangements create material risks to thecompany.Company. •Responsible for compensation actions and decisions with respect tocertain senior executives, as described in theCompensation Discussion and Analysisbeginning on page 37.page 38. |

| | | | | |

| FINANCE, INVESTMENT AND RISK MANAGEMENT COMMITTEE |

CURRENT MEMBERS: R. Allardice III (Chair)

L. De Shon C. Dominguez T. Fetter D. James K. Mikells (Chair) M. MorrisE. Reese

T. Roseborough V. Ruesterholz C. Swift M. Winter G. Woodring MEETINGS IN 2021:2022: 5 | “In 2021,2022, FIRMCo continued to devote substantial time to reviewing the COVID-19 pandemic’s effect on the risk profile of the company, including impacts to insurance coverages, the economy and financial markets, and the legal and regulatory environment. The committee also regularly reviewed the macroeconomic outlook and its implications for the Company’s investment portfolio and insurance underwriting performance; emerging risks related to cyber insurance and the evolving external threat environment,environment; property catastrophe exposures, particularly in light of the implications ofpotential climate change and severe weather, as well as the ongoingweather; and insurance underwriting practicespractices. The Committee also continued its review of The Hartford.the COVID-19 pandemic’s effect on the risk profile of the Company, including impacts to insurance coverages and the legal and regulatory environment.” Robert B. Allardice III,Kathryn Mikells, Committee Chair since 20162022

ROLES AND RESPONSIBILITIES •Reviews and recommends changes to enterprise policies governing managementactivities relating to major risk exposures such as market risk,risk; liquidity and capitalrequirements,requirements; insurance risks, including acts of terrorism and changing climate or weather patterns,patterns; and any other risk that poses a material threat to the strategic viability of the company.

•Reviews the company's overall risk appetite framework, which includes an enterprise riskappetite statement, risk preferences, risk tolerances, and an associated limitstructure for each of the company's major risks. •Reviews and recommends changes to financial, investment and riskmanagement guidelines. •Provides a forum for discussion among management and the entire Board of keyfinancial, investment, and risk management matters. |

| | | | | | | | |

| 20222023 Proxy Statement | 19 |

| | | | | | | | |

| BOARD AND GOVERNANCE MATTERS | | |

| | | | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

Current Members: L. De Shon C. Dominguez M. MorrisD. James

T. Roseborough (Chair) V. Ruesterholz